EU Methane Regulation Comes into Force

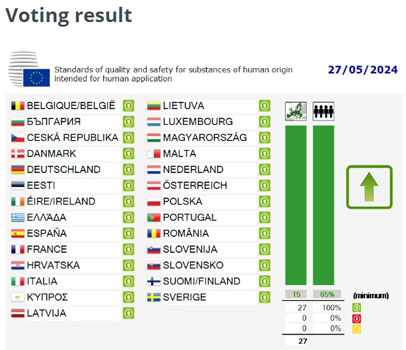

The EU Methane Regulation—first proposed in December 2021—was approved by the Council of the EU on May 27, 2024 as part of the ‘Fit for 55’ legislative package with a near unanimous vote by member states. The regulation applies to all EU Member States from July 2024.

What do the new EU rules involve?

Measuring and reporting

- Requirements to measure, report, and verify methane emissions in the energy sector

- Measurements to be checked by independent verifiers

- Regular monitoring by oil and gas companies of their equipment to detect leaks and identify repair needs

- Public inventories of inactive wells and coal mines

Reducing emissions in the EU

- Immediate reductions through mandatory leak detection and repair, and by limiting the release of methane at energy production plants (venting and flaring)

- Mitigation plans by member states

- Emissions reduction actions also for inactive or abandoned extraction site

Tackling energy imports

- Global monitoring tools to ensure the transparency of emissions from imports of fossil fuels

- The obligation to trace emissions of energy imports

Courtesy of

European Council

Oil and gas operators have an opportunity to exceed

the new standards to gain competitive advantage.

What is the EU Methane Regulation?

The regulation introduces obligations for oil and gas operators in oil and gas exploration and production (onshore and offshore), gas gathering and processing, gas transmission, distribution, underground storage and operations in liquified natural gas (LNG) within the EU on methane that include:

- Measurement, reporting, and verification (MRV).

- Mitigation of emissions including

use of:

- Leak detection and repair (LDAR)

- Venting and flaring (V&F): restrictions, reporting, flaring efficiency requirements

- Quantification and mitigation of emissions from inactive, temporarily plugged, and permanently plugged and abandoned oil and gas wells.

Quantification requires third party verification for reporting to the relevant authorities.

The regulation also specifies obligations for fossil fuel importers on methane:

- Information provision.

- Demonstrating equivalence of MRV.

- Methane intensity of the production of crude oil, natural gas, and coal—reporting of methane intensity and demonstrating the imports remain below the maximum methane intensity values.

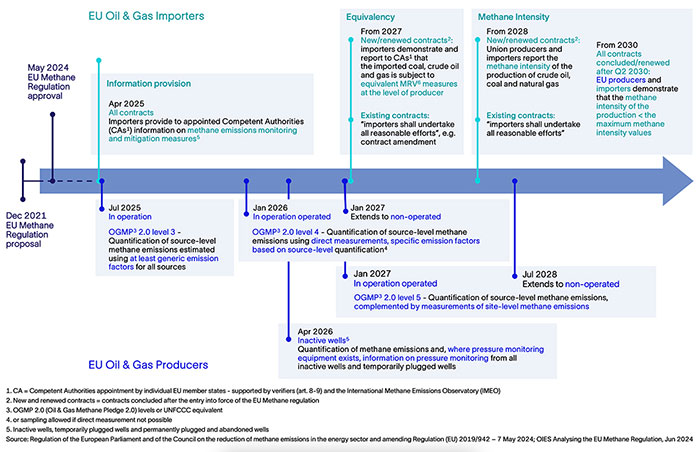

An infographic of the regulations to be enacted by member states is provided below. The Oxford Institute of Energy Studies (OIES) provides a comprehensive analysis of the recently approved regulation..

What's next as the regulation is implemented?

Image source: https://video.consilium.europa.eu/event/en/27485

With EU Council approval, the regulation will apply to the 27 EU Member States and will come into force this year. Applicability to the three European Economic Area (EEA) countries—Iceland, Liechtenstein, and Norway—will be subject to the EEA Joint Committee.

While the regulation lays out the principles, key details still need to be developed by the Commission and member countries via delegated and implementing acts. This includes the development of MRV templates, development of methodologies to calculate methane intensity, digital infrastructure to facilitate submission of reports, and the creation of a methane transparency database.

This is on top of appointment of the Competent Authorities (CAs), as well as providing clarity over overlapping responsibilities with National Regulatory Authorities (NRAs) and associated regulations such as the Gas Directive, EU Emissions Trading Scheme (ETS) (including clarify of boundaries of LNG shipping under the purview of EU ETS), and the Carbon Border Adjustment Mechanism (CBAM).

What does this mean for oil and gas operators?

Though there are still many details to be worked-out in the implementation of the regulation, it represents a substantial effort by the EU to curtail methane emissions in the energy sector. Once implemented, this regulation mandates rigorous monitoring, reporting, and verification (MRV) standards, alongside stringent measures to eliminate routine flaring and venting. For upstream oil and gas operators, this regulatory shift presents both a challenge and an opportunity—one that demands proactive action for several compelling reasons:

- Regulatory compliance and operational efficiency:

The regulation requires oil and gas operators to adhere to the highest MRV standards, demanding precise measurement and documentation of methane emissions. By investing in advanced technologies for leak detection and repair, companies can not only comply with these regulations but also identify and rectify inefficiencies in their operations. This proactive approach can lead to significant cost savings by reducing wasted resources and improving overall operational efficiency. The first horizon is for EU operators to report to OGMP 2.0 Level 3 in 2025, following implementation by each member state. EU importers (with information provisions in 2025), and thus exporters to EU, will need to follow suit quickly after.

- Risk mitigation and long-term viability:

Failure to comply with this stringent regulation could result in substantial fines and legal repercussions for companies. Moreover, the regulation includes provisions for a rapid alert mechanism for "super-emitting" events, ensuring immediate action on significant methane leaks. By proactively addressing potential emission sources, companies can mitigate regulatory and environmental risks, ensuring long-term viability and stability in an increasingly regulated market.

- Economic incentives and innovation:

The regulation is part of the broader European Green Deal and REPowerEU initiatives, which include economic incentives for companies that invest in clean energy technologies and innovation. By leveraging these incentives, there is an opportunity for oil and gas operators to fund the transition to more sustainable practices, driving innovation in methane detection and mitigation technologies. This not only helps meet regulatory requirements but also fosters a culture of continuous improvement and technological advancement.

- Global leadership and competitive advantage:

The EU regulation aims to reduce methane emissions from imported fossil fuels meaning that international suppliers must meet similar standards to access the European market. Companies that adopt and exceed these standards early will gain a competitive advantage.

Learn more about our digital sustainability solutions.